nj property tax relief check

In Fiscal Year 2022 over 760000 New Jersey families will receive an up to 500 tax rebate due to the Millionaires Tax enacted by the Governor and. NJ Division of Taxation - Local Property Tax Relief Programs.

Nj Property Tax Relief Program Updates Access Wealth

Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits.

. Stay up to date on vaccine information. It was established in 2000 and is an active participant in the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

For those who qualify the checks are supposed to effectively freeze property-tax bills that now average an all-time high of 9112 in New Jersey. For information call 800-882-6597 or to visit the NJ Division of Taxation. Phil Murphy reached last year to raise taxes on people who make more.

This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program. Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms.

Senior Freeze Property Tax Reimbursement Inquiry. The rebate check program comes as part of a 319 million package that Gov. If its approved by fellow Democrats who.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. NJ Division of Taxation - Local Property Tax Relief Programs. Deductions exemptions and abatements.

All Property Tax Relief Benefits are Subject to Change. One way of saving a penny or two is by applying for NJ property tax relief programs such as. The most anyone can get back is 500.

Moving forward homeowners will receive an annual payment based on their. Phil Murphy unveiled Thursday. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main home.

All property tax relief program information provided here is based on current law and is subject to change. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. Im proud to say that three of the five lowest property tax increase ever on.

To qualify you must meet all the eligibility requirements for each year from the base. The rebates will be hitting the mail as soon as July 1 sending 500 to over 750000 New Jersey families. Dont Miss Your Chance.

Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled. Prior to the passage of the new budget the state used 2006 tax information to calculate each homeowners annual relief check averaging around 500. As one of the most expensive states to live in NJ citizens may need help paying property taxes to keep up with the high cost of living.

That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits. COVID-19 is still active. You will get the difference between your base year first year of eligibility property tax amount and the current year property tax amount as long as the current year is higher than the base year and you met all other eligibility.

Property Tax Relief Programs. To use this service you will need the Social Security number that was listed first on your Senior. New forms of aid.

Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov. Check If You Qualify For This Homeowner StimuIus Fast Easy. New Jersey Gross Income Tax Write your Reference Number on the memo line.

For New Jersey homeowners making up to 250000 rebates would be applied as a percentage of property taxes paid up to 10000. If a reimbursement has been issued the system will tell you the amount of the reimbursement and the date it was issued. The most anyone can get back is 500.

Property Tax Jan 17 2013 - New Jerseys current rate of 9 Income including spouses income cannot exceed 10000 per year not including Social Security or federal Income. Mail the check and notice voucher to. New Jersey Income Tax PO Box 444 Trenton NJ 08646-0444.

Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. The latest round of benefits scheduled to be paid in May 2022 are intended to offset the property-tax bills from 2018. The Homestead Benefit program provides property tax relief to eligible homeowners.

About 760000 middle class families are expected to receive rebate checks of up to 500 as part of the deal lawmakers and Gov. Review the updates to learn whether you may benefit from New Jersey property tax reform measures. New Jersey Gov.

For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did receive a prior years reimbursement. The rebate amount is equal to the tax paid after credits line 50 up to a maximum amount of 500. What Are New Jersey Property Tax Relief Programs.

That means if the amount on line 50 is less than 500 you will receive a check for the amount shown on line 50. If the amount on line 50 is 500 or more you will receive a check for 500. The checks part of a deal Murphy cut with top Democratic lawmakers last year to institute a millionaires tax come as the governor vies for.

Interest at a rate of 8 per annum up to 1500 New Jerseys Legislature was recalled on Tuesday for a special session on property-tax relief after enacting a 29. However New Jerseys most expensive property-tax relief program according to budget documents allows homeowners regardless of their annual income to deduct up to 15000 in local property taxes annually. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms.

Renters making up to 100000 would be eligible for direct payments. Tax Collector Check the Box on Part II of PTR-1A2A if there was a tax appeal. About the Company Nj Property Tax Relief Fund Check 2021 CuraDebt is an organization that deals with debt relief in Hollywood Florida.

NJ Division of Taxation. Phil Murphy and lawmakers agreed to in September with about 800000 New Jersey residents eligible to receive a 500. For instance an eligible family who paid 200 in taxes will get a 200 rebate check.

Call NJPIES Call Center.

Cancellation Of Homestead Deduction The District Of Columbia Here S A Free Template Create Ready To Use Forms A Deduction District Of Columbia How To Apply

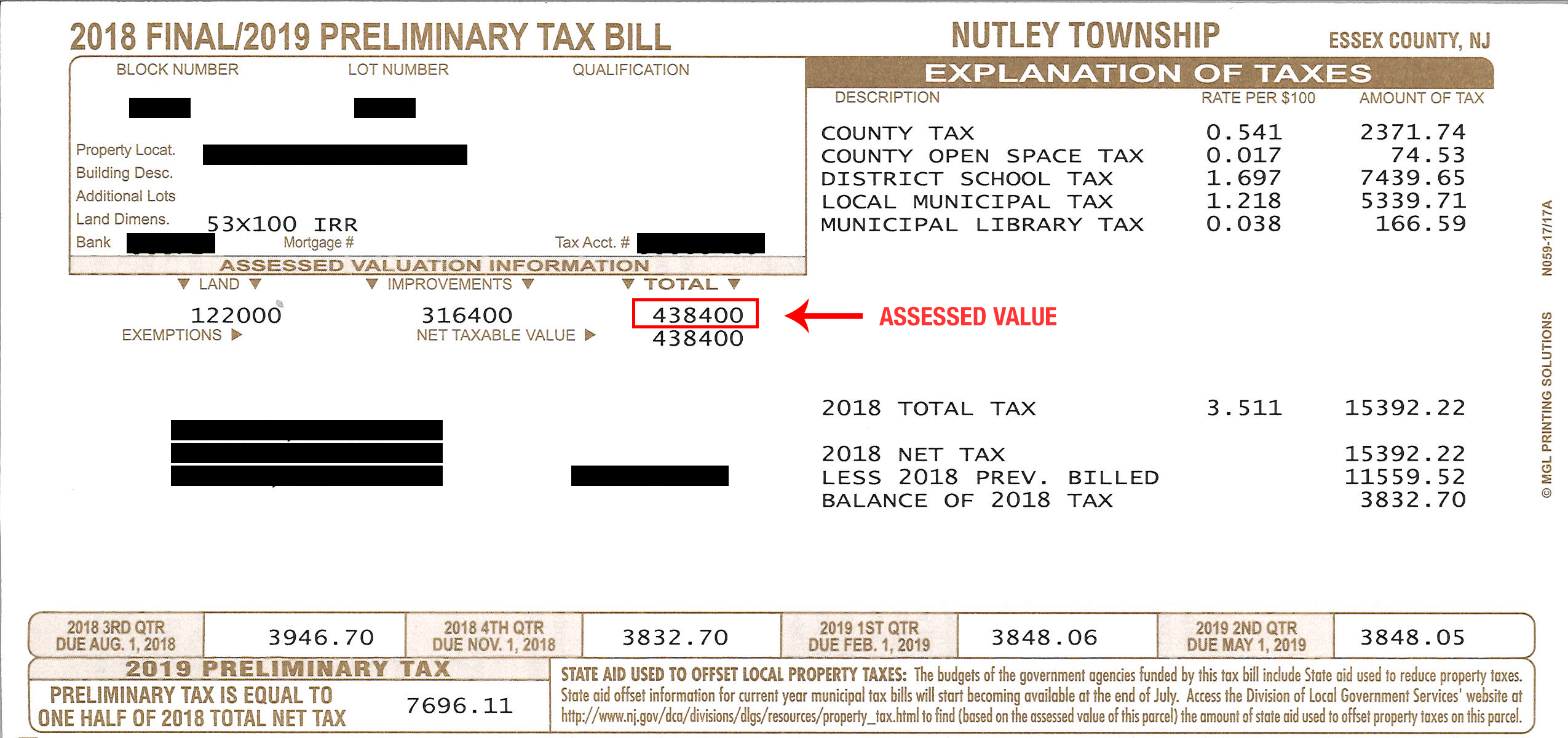

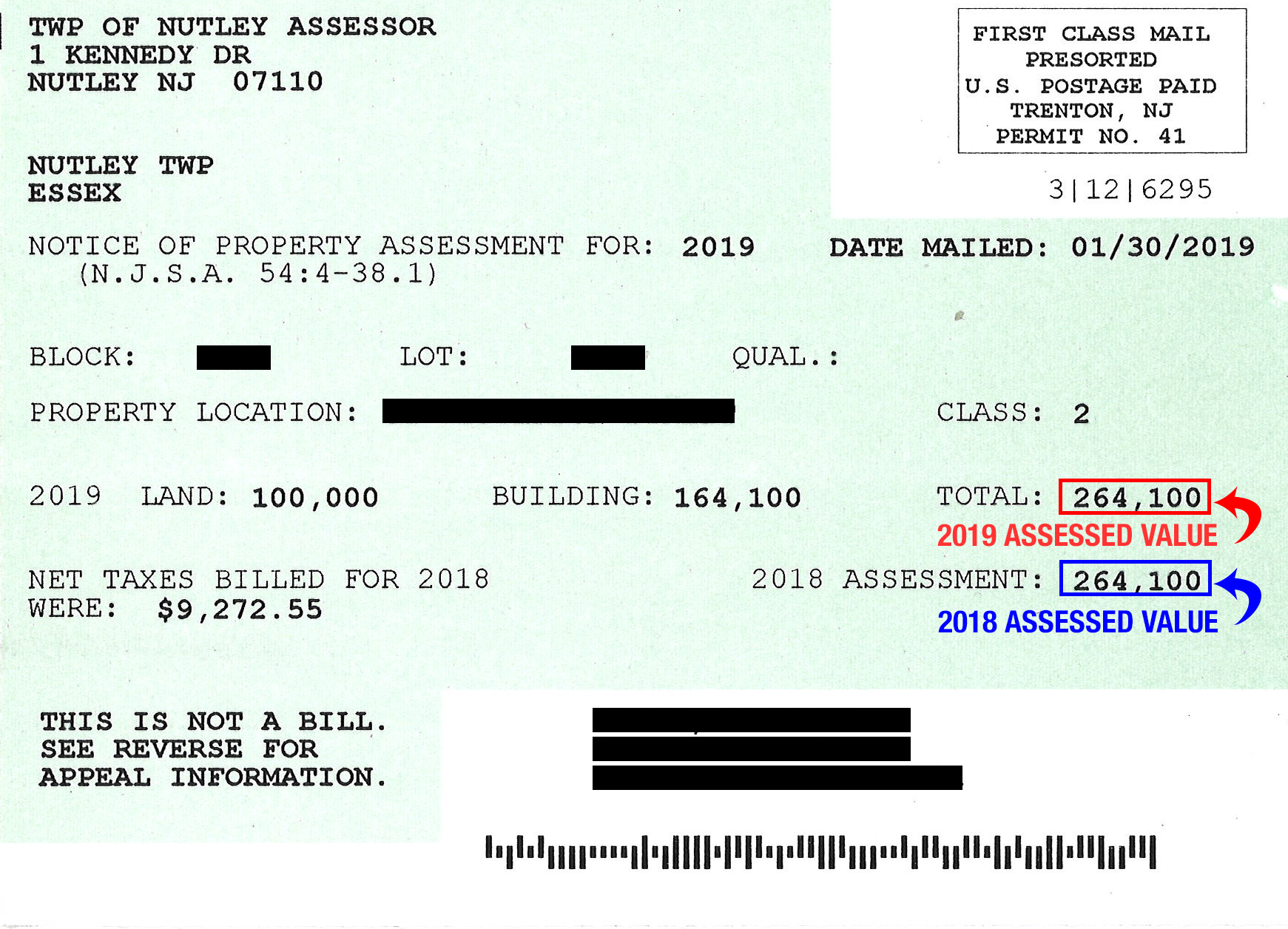

Freehold Township Sample Tax Bill And Explanation

Benefits Of Owning A Home Advantages Of Owning A Home Re Max Nj Home Ownership Home Buying Buying A New Home

Township Of Nutley New Jersey Property Tax Calculator

Deducting Property Taxes H R Block

The Official Website Of The Township Of Belleville Nj Tax Collector

Pin On Pinterest Real Estate Group Board

Back Tax Help Johnson City Tn 37601 M M Financial Blog Tax Help Back Taxes Help Irs Taxes

Freehold Township Sample Tax Bill And Explanation

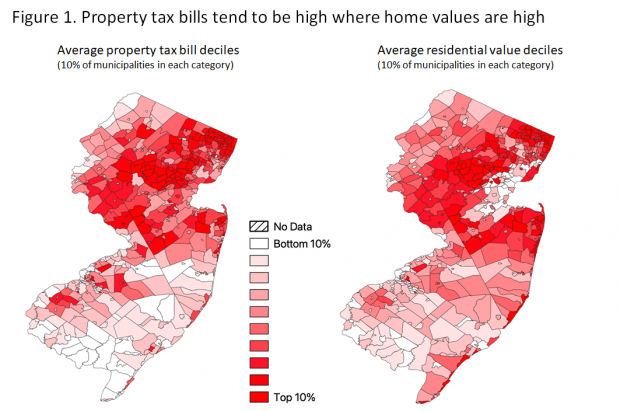

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Nj Property Tax Relief Program Updates Access Wealth

Pin On Real Estate Investing Tips

Real Property Tax Howard County

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

How Taxes On Property Owned In Another State Work For 2022

Township Of Nutley New Jersey Property Tax Calculator

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States